Is there a problem?

May 15, 2019

Growing up in Newfoundland and Labrador, we were taught to first try to fix something yourself. If you failed, it wasn’t a big deal, there was always someone else you knew, a brother-in-law or neighbour, who might be able to fix it. Only once you’d exhausted your contacts did you call in a professional.

That’s all well and good, but what about when you don’t even know you have a problem…who do you check with then? It can’t be a problem if you don’t know it is, right?

If you believed a service provider or supplier was charging you more than necessary, is that a problem? Most people would say yes, but how can that be solved? And how do you become aware of that?

In our experience, the best way is to gather market data, quotes, prices etc. and to make your case. If that doesn’t work, you always have the ability to “fix” the problem by walking away from the relationship and finding another provider, but that can create more problems if the process is not correctly managed.

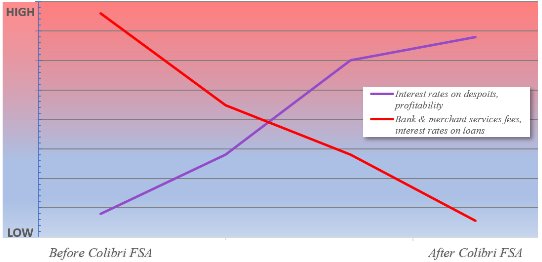

At Colibri FSA, we believe most companies have higher banking costs than are necessary. While your banker may tell you that you are “at market” our experience shows that there are better deals available if you know how, and where to look, what questions to ask, and what information to provide. Besides, your banker only knows what their bank considers to be “at market.” They don’t see the forest from behind their trees.

When you engage with Colibri FSA, you get the benefit of our full market knowledge, our non-partisan 40 years of banking experience and our Colibri FSA guarantee…if we cannot negotiate a significantly better financial agreement on your behalf, there are no fees. Our fees are only charged when you benefit.

We can help – even if you don’t think there’s a problem!